Why I don’t believe in only having a joint account ❌

The hidden dangers of combining your finances

Hi friend,

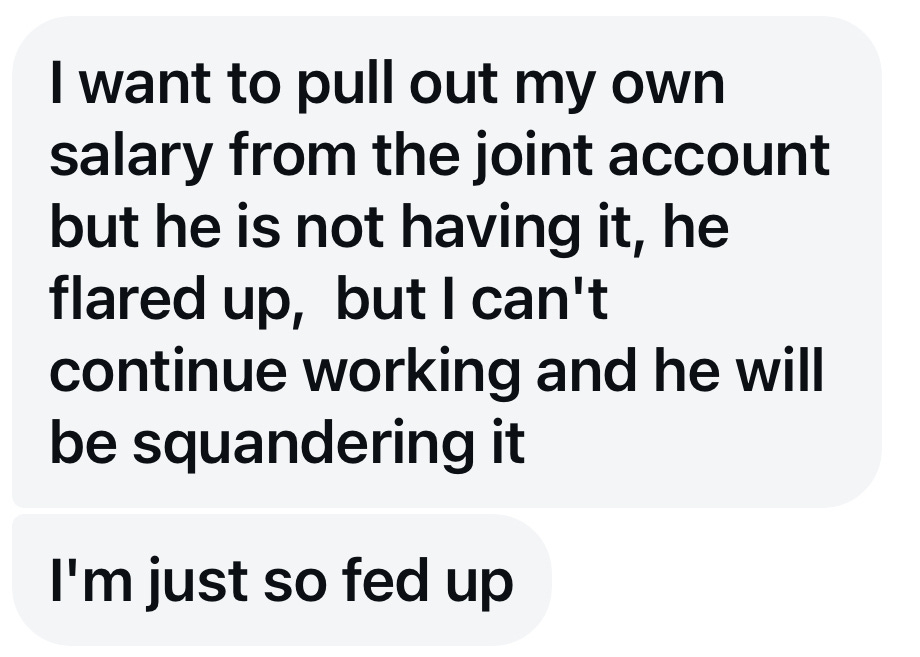

I wasn’t going to talk about this today… until I got this DM:

And my heart sank.

Because this isn’t just one woman’s story. I’ve heard versions of this too many times, from women who are married, living with partners, or even just dating. Women who love deeply and want to build with someone, but somewhere along the line, they’ve lost access to their own money.

Let’s talk about it.

We often hear that couples should “do everything together” - live together, plan together, merge finances. And yes, there’s beauty in financial unity. I believe in joint accounts. I have one. I believe in shared goals and using joint accounts for shared expenses. But what I don’t believe is that your entire salary should land in a joint account while you, the person doing the work, have no visibility, no control, and nothing in your name.

Love shouldn’t cost you your independence.

I’ve seen too many women go from thriving professionals to adults who don’t even know what day their salary comes in. Some don’t know the password to their banking apps, and others have no idea how much is being saved or if anything is being saved at all.

And by the time they realise things aren’t working, they’re emotionally drained and financially stuck 😰.

Sometimes it starts slowly.

“We’ll just use the joint account for bills.”

Then it becomes, “Let’s both get paid into it.”

Before long, she’s asking for “permission” to buy deodorant or send money to her mum. And when she asks to pull her salary out? It turns into a fight.

I know this because I’ve seen it. I’ve read the DMs. I’ve heard the phone calls. And even outside of relationships, I’ve seen many women proudly say “he handles the finances” as if it’s a badge of honour to be completely removed from the money conversation.

There’s a difference between not managing the finances and not knowing anything about them.

You can delegate without disappearing.

It’s one thing to say, “My husband does the spreadsheets because he enjoys it.” Cool. But do you know how much your rent or mortgage is? Can you confidently say how much debt is in your household? Do you know your utility providers? Do you have access to every account your name is attached to? No?

You don’t have to be the finance lead, but you should always have a seat at the table.

It’s okay if you don’t want to lead the financial planning in your relationship… but not knowing anything? (haba sis?? 😟)

That’s how people end up in financial disasters they didn’t even see coming.

I’ve always said this - have your own account. Let your salary come to you first, then move money into the joint account for agreed-upon expenses. That’s not secrecy. That’s structure.

Even now in my own marriage, we plan together. We save together. But I have my own bank account, my own investments, and I check in with our numbers regularly. Not because I don’t trust my partner, but because I trust myself to stay financially awake.

And if you’re in a situation right now where you’ve already given up that control, I’m not judging you. I just want you to know you can take it back. It’s not too late to start asking questions. To ask for visibility. To move your salary. To say, “This isn’t working for me anymore.”

Because partnership doesn’t mean sacrifice without boundaries.

And if you're the one in charge of the money in your relationship, don’t gatekeep it. Don’t weaponise it. Share the passwords. Explain the bills. Invite your partner into the conversation. Financial transparency is part of intimacy 💞.

Let me say it louder for the people at the back:

You can build together and still have your own.

You can love someone and still say no.

You can be unified without being financially erased.

If no one has told you lately, you deserve to feel safe, respected, and included when it comes to your money. Don’t let anyone guilt you out of that. And even if you don’t fully agree with me on joint accounts, that’s okay, but I’ve seen too many women lose their independence and access in the name of “oneness”, and that’s what I’m speaking to.

🎥 New Video

How I Doubled My Salary in 12 Months

This week’s video is one I’m really proud of 🤭. It’s a deep dive into the actual steps I took to grow my 9-to-5 income. No fluff. Just real, strategic moves that helped me build confidence, get clear on my value, and negotiate well.

If you’ve been wondering how to earn more without quitting your job or starting five side hustles 👀, this one’s for you. The feedback on this video has been incredible so far, and I know it’ll encourage you too.

That’s it for this week.

If this Dispatch hit close to home, I see you. If you’ve ever felt financially erased in the name of love, I hope you find the strength to take some of that power back — slowly, safely, and in your own time.

If you're looking for community and accountability on this journey, my private group is launching soon, with monthly check-ins, live sessions, and money resources that go deeper than what I share online. Founding members on the waitlist will get exclusive perks and early bird pricing.

And if you’d like to book a 1-on-1 finance session with me, I have opened up a few discounted slots, 👉🏽 you can book here.

Till next week,

We move with clarity and courage 💼

XOXO - Chidera

P.S. I'd be so grateful if you could tap that like button below or leave a comment, it helps others discover this content. And if you're enjoying what you read, consider becoming a paid subscriber. Thank you for being here! ✨

Oftentimes we let love blind us from certain realities, especially how unpredictable life can be, that our finances begin to take the downward slope.

I just hope more women not just read this but also UNDERSTAND the point and LEARN from it💖.

Thank you Chidera for this enlightening piece💕💕.

Thanks a million for being an inspiration.

"Love shouldn't cost you your independence" ooph say it louder in the back. This was a wonderful piece and I hope more women take control of their finances and get out of toxic and controling relationships.